If the inventory balance increases, that means more cash is tied up in the operations of the business, as it is taking longer for the company to sell and get rid of its inventory than it is to produce it. Cost of Goods Sold (COGS): On the income statement, the COGS line item represents the direct costs incurred by a company while selling its goods or services to generate revenue.Īn increase in an operating working capital asset, such as inventory, represents an outflow of cash, which is why in the free cash flow formula, an increase in working capital (i.e., current operating assets minus current operating liabilities), results in a reduction in FCFs.Inventory: On the balance sheet, the inventory line item represents the dollar value of the raw materials, work-in-progress goods, and finished goods of a company.In order to compute a company’s days inventory outstanding, two inputs are necessary: Thus, companies attempt to minimize their days inventory outstanding to limit the time that inventory is sitting in their possession.

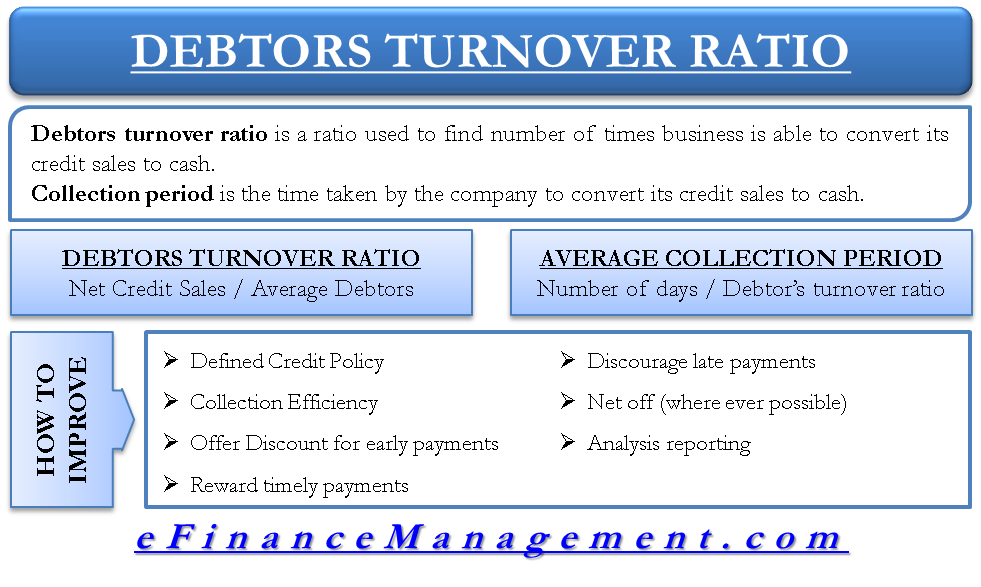

OPERATIONAL WORKING CAPITAL TURNOVER HOW TO

How to Calculate Days Inventory Outstanding (DIO)?ĭIO, or “days inventory outstanding”, measures the number of days required for a company to sell off the amount of inventory it has on hand.

0 kommentar(er)

0 kommentar(er)